Offshore Company Formation: A Step-by-Step Guide to Starting Your Global Business

Offshore Company Formation: A Step-by-Step Guide to Starting Your Global Business

Blog Article

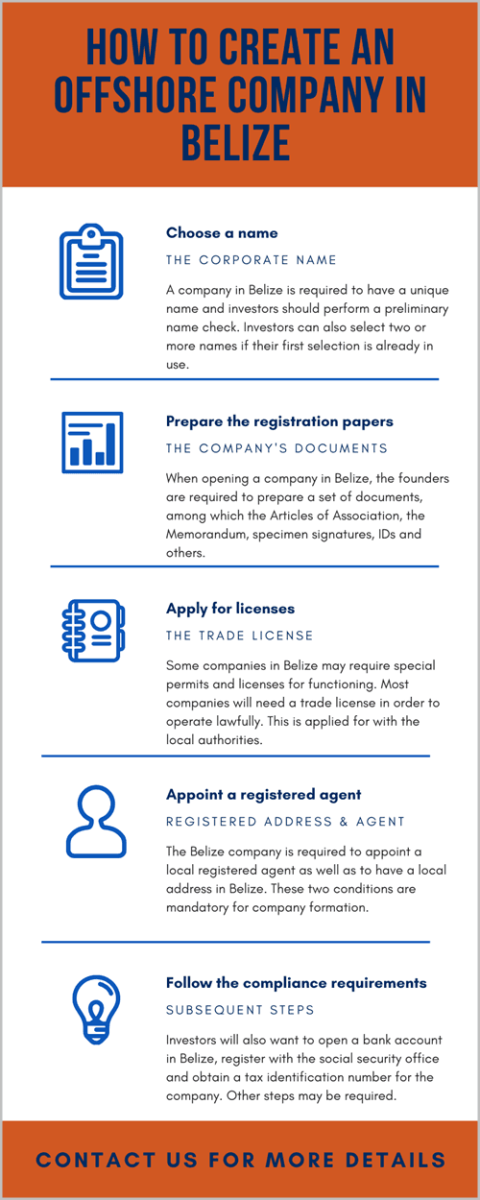

Step-by-Step Process for Effective Offshore Business Formation

The development of an overseas firm demands a systematic approach to ensure conformity and viability in a competitive landscape. It starts with the mindful choice of a territory, taking right into account variables such as political stability and tax effects. Following this, recognizing the elaborate lawful needs and preparing important documentation is important. This procedure culminates in establishing a financial partnership that lines up with organization goals. Yet, numerous overlook the importance of continuous conformity, an essential aspect that can make or break the success of an offshore venture. What might this require for your specific scenario?

Picking the Right Jurisdiction

Choosing the suitable territory is an essential step in the procedure of overseas business development (offshore company formation). The selection of territory considerably affects the functional effectiveness, tax obligations, and regulatory conformity of the offshore entity. Factors such as political security, financial setting, and the reputation of the territory need to be meticulously evaluated

Firstly, consider the tax routine; some jurisdictions supply desirable tax obligation rates and even tax obligation exemptions for overseas firms, which can improve profitability. Assess the governing structure, as some territories have a lot more flexible policies that can help with service operations while ensuring conformity with global requirements.

In addition, the availability of professional services, such as legal and accountancy assistance, is essential for seamless operations. Territories with a well-established framework and a robust monetary solutions industry can provide far better sources for offshore businesses.

Understanding Lawful Requirements

One of the primary factors to consider is the selection of territory, as it directly affects the regulative environment. Aspects such as tax obligation motivations, personal privacy legislations, and simplicity of doing business needs to be thoroughly examined. Several jurisdictions call for a local licensed agent or workplace, which can offer as a point of get in touch with for legal correspondence.

Furthermore, it is important to realize the effects of international regulations, specifically concerning anti-money laundering (AML) and combating the financing of terrorism (CFT) Compliance with these requirements is typically scrutinized by economic establishments and regulative bodies.

Preparing Needed Paperwork

When the legal requirements have actually been comprehended, the following action in the offshore business development procedure involves preparing the necessary paperwork. This stage is important, as the accuracy and completeness of these files can considerably influence the success of the incorporation procedure.

Trick papers commonly consist of a memorandum and write-ups of association, which describe the company's framework, purpose, and functional policies. Additionally, you will require to give evidence of identification for all directors and investors, such as keys or nationwide identification cards, together with proof of house, like utility bills or bank declarations.

Depending on the jurisdiction, specific kinds might be required to sign up the business, which need to be loaded out carefully - offshore company formation. Some jurisdictions may likewise ask for a service plan outlining the intended procedures and monetary forecasts of the company

It is a good idea to speak with a legal specialist or unification solution to make sure that all papers fulfill the jurisdiction's needs. Proper prep work not just quickens the registration procedure yet also helps reduce potential legal problems in the future. When all documentation is prepared and confirmed, the following action in the formation process can start flawlessly.

Opening a Checking Account

Developing a bank account is an important action in the offshore company formation process, as it helps with financial transactions and boosts the business's integrity. An overseas checking account offers the necessary facilities for carrying out global service, permitting reliable monitoring of invoices, funds, and payments.

To open an offshore checking account, it is important to study various financial institutions to identify those that line up with your company needs. Variables to take into consideration include costs, services offered, account kinds, and the financial institution's track record. When you have actually picked a his response financial institution, prepare the required documents, which commonly consists of proof of identity, evidence of address, and corporate records such as the company's certificate of consolidation and memorandum of association.

It is recommended to set up a visit with the bank to discuss your particular demands and develop check out here a connection with the bank representatives. Some banks may require a minimal down payment or charge upkeep costs, so comprehending these problems beforehand is essential. After the account is effectively opened, ensure that you acquaint yourself with the online banking system and readily available solutions to successfully manage your offshore finances.

Preserving Conformity and Coverage

In the world of overseas firm formation, maintaining compliance and reporting is paramount to making sure the longevity and validity of your company operations. Failure to abide by governing needs can result in severe penalties, including penalties and the possible dissolution of your firm.

To preserve conformity, it is vital to comprehend the details legal responsibilities of the jurisdiction in which your offshore entity is registered. This frequently consists of yearly declaring of monetary declarations, income tax return, and various other obligatory disclosures. Remaining notified regarding modifications in local regulations and policies is necessary, as non-compliance can develop from outdated techniques.

Frequently carrying out internal audits can better enhance compliance efforts. This aids identify any kind of inconsistencies in financial reporting or functional techniques before they escalate right into severe issues. Additionally, involving with a regional legal or financial consultant navigate to this site can offer invaluable assistance on maintaining compliance and sticking to best practices.

Verdict

To conclude, the effective development of an overseas company demands a systematic method incorporating the option of an ideal territory, understanding of lawful requirements, complete prep work of documentation, facility of an ideal checking account, and thorough upkeep of conformity with local guidelines. Abiding by these essential phases not only boosts the chance of success yet also ensures the long-term sustainability of the overseas entity in a complex global company environment.

The development of an overseas firm demands a systematic approach to make sure compliance and practicality in a competitive landscape.Choosing the appropriate jurisdiction is a vital action in the procedure of overseas company formation. The option of territory considerably affects the operational effectiveness, tax responsibilities, and regulative conformity of the offshore entity.Navigating the lawful requirements for offshore company development can be complicated, yet it is essential to ensure conformity with both global and local regulations.To maintain conformity, it is important to comprehend the particular legal responsibilities of the territory in which your offshore entity is registered.

Report this page